1. Go paperless

Keep all your receipts in a shoebox? There's a better way. Our free doc scanner makes saving receipts and physical forms as simple as snapping a photo. Just tap (+) Create in the Dropbox mobile app to transform paper docs into high-quality PDFs or PNGs. Then you can store and organize all your records together in a single tax folder on Dropbox. And you'll know exactly where to find your medical bills, W-2s, and 1099s right when you need them.

2. Make filing quick and painless

We've all been there: You finally finish your taxes but can't file until you find last year's AGI. It's a frustrating feeling and will certainly cost you time and unnecessary stress. Create a tax folder in Dropbox, your one-stop-shop for all your receipts and tax forms. Everything is neatly organized and easily accessible. You can even take pictures of receipts and convert them to PDFs. With the PDF editor, you can reorganize pages and leave comments for yourself or an accountant. Then, with Dropbox Sign, you can save travel time and postage by adding legally binding eSignatures. Plus, you'll always know where to find the document you need to file, including previous years' returns.

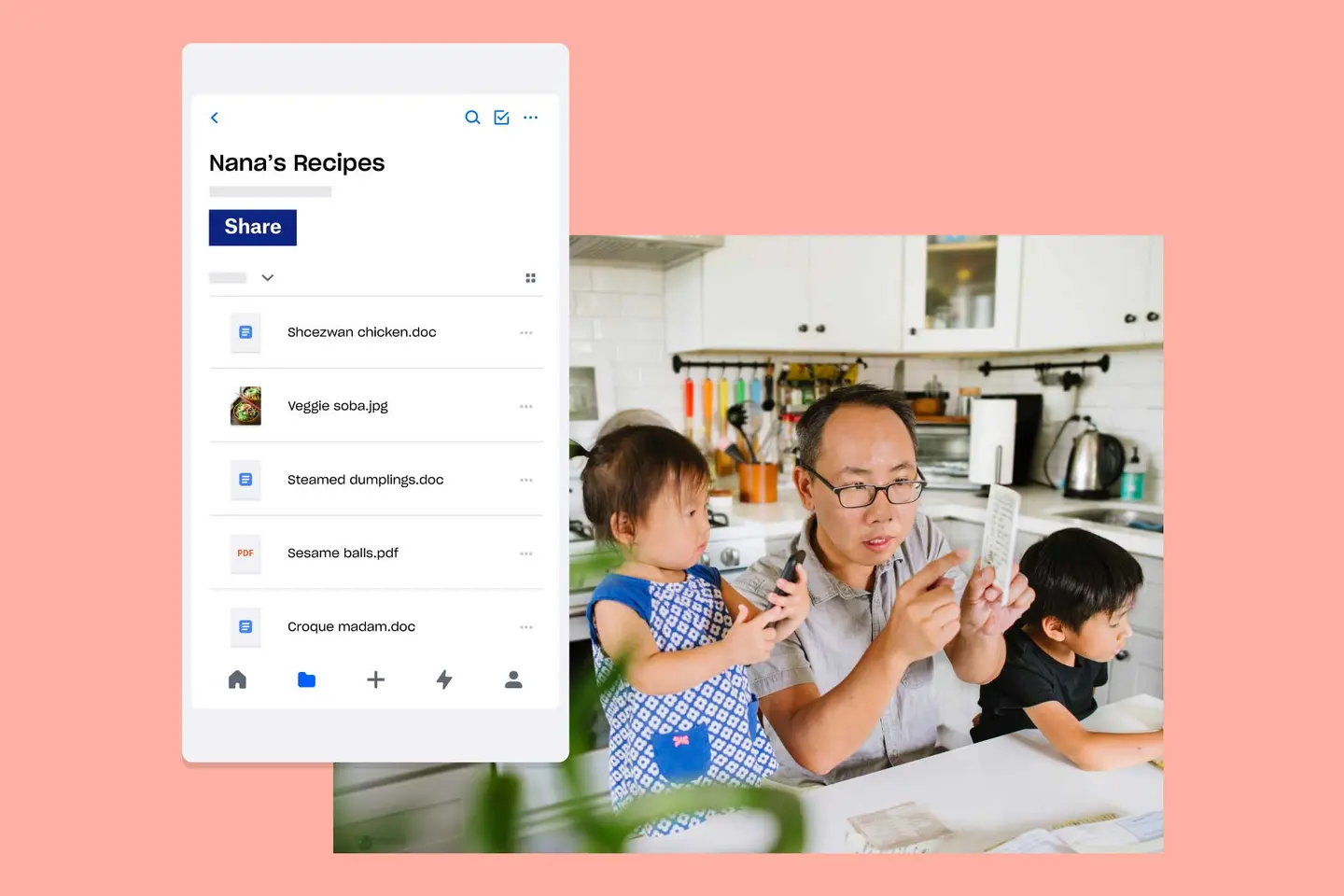

Working with an accountant? Don't send sensitive financial files as attachments over email. Instead, you can securely share your entire tax folder with a few clicks. You can even set specific access permissions, like making a folder view only, for extra peace of mind. And with our Pro plan, you can set a link expiration date or password protect any shared file or folder.

3. Protect your financial info

Dropbox has multiple layers of security to safeguard your most sensitive files. But you can take a few extra steps to protect your personal data:

- Choose a strong password and enable multi-factor authentication for your Dropbox account

- Lockdown your laptop or mobile device with a login password or PIN

- Use full-disk encryption to protect your data if your device gets lost or stolen

- Ask your account or tax preparer how they secure their accounts and devices

BONUS: Forms for business owners

When you run your own business, tax season brings a whole set of additional paperwork to file with the IRS. Dropbox Forms lets you transform complex PDFs into mobile web forms without sacrificing security. And, if you need ready-to-go documents, FormSwift offers a complete suite of business and legal document templates, including 1099-NECs, W2s, and W9s. Reduce the unrelated and repetitive questions that normally accompany the collection of necessary data by turning payroll, financial, tax documents, and more into a mobile-friendly, hassle-free, guided experience that anyone can understand.

With these tips in your tool belt, you're well on your way to one of the best moments of the year. Get ready to check 'File Taxes' off your to-do list!